What's options rolling

1. What's options rolling

Roll your options position by closing an existing position (and realizing any gains or losses) and simultaneously opening a new one with different contract terms, such as a later expiration date, a different strike price, or both. You may choose to roll your options positions in different ways based on your trading strategies.

2. How to roll options

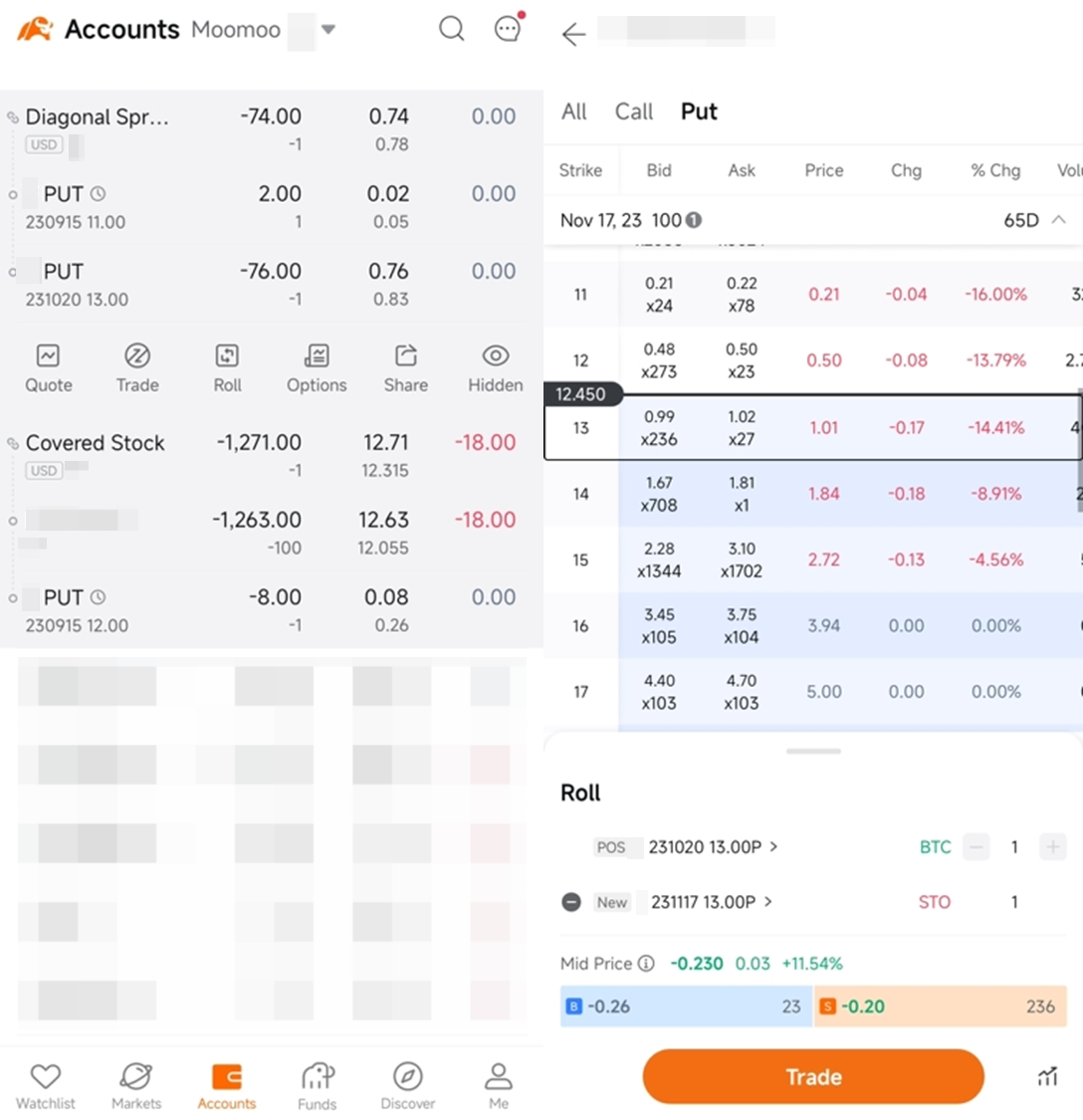

To roll your options in the app:

-

Go to the Assets tab

-

Select the options position you'd like to roll and tap Roll

-

Select the leg(s) you'd like to roll and tap Trade

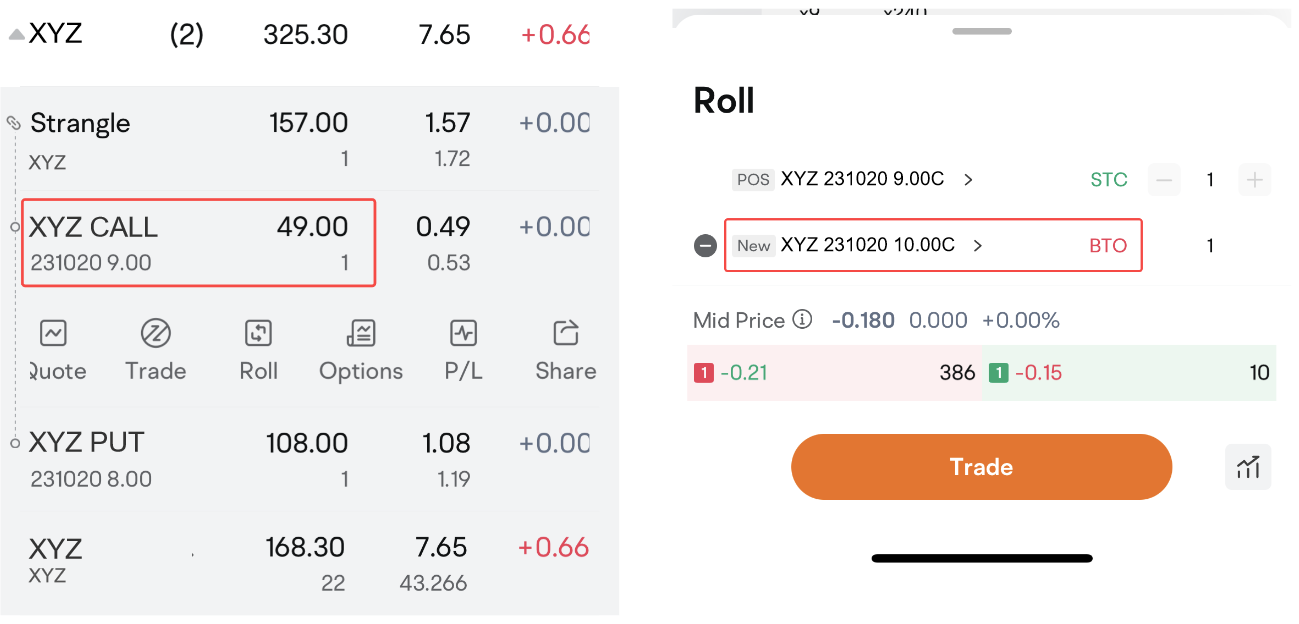

2.1 Roll some legs of your options strategy

When rolled, the open legs of your options strategy you've selected will attempt to be closed. The system will then attempt to form a new strategy by using the remaining legs and the newly opened contracts by the rolling trade placed by the client. If they can't form any strategy, they may both become single options, or separately pair with other single positions as an option strategy if any.

(Please note that the interface shown in the screenshot may differ from the one on your device if your app version is not up-to-date. Any securities appearing in the screenshot are for illustration only and do not constitute any investment advice. )

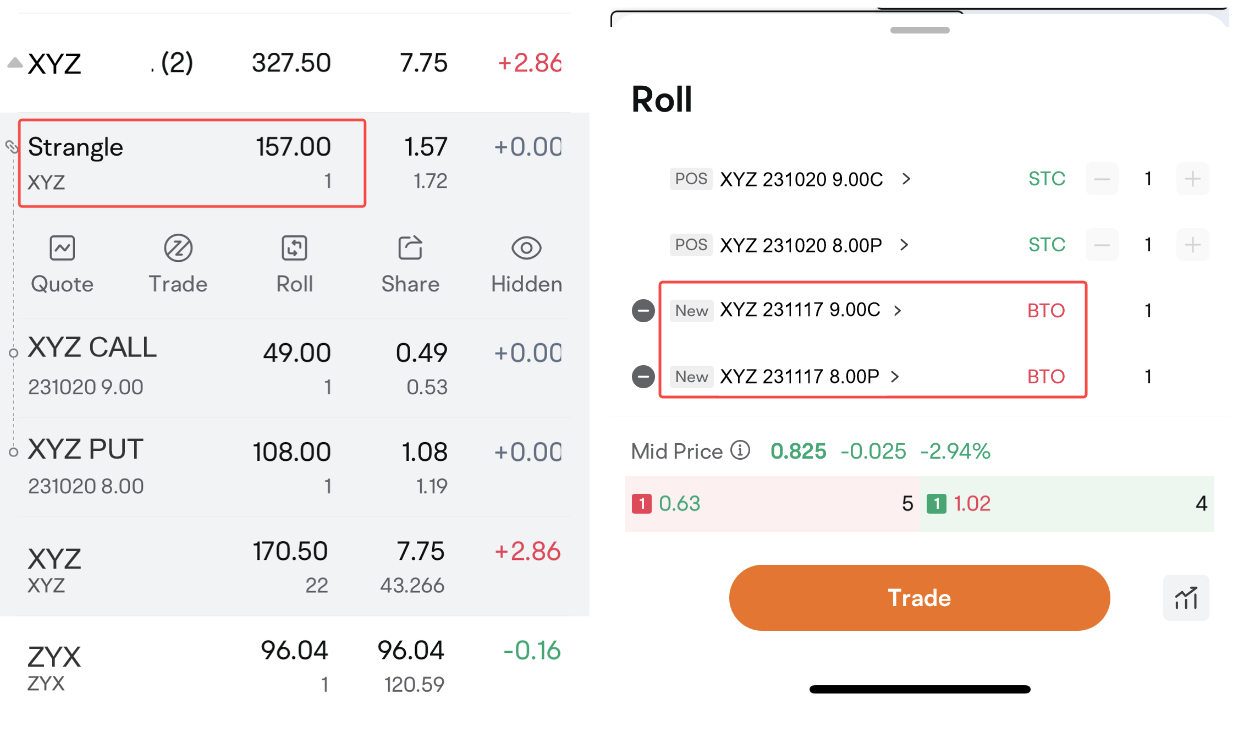

2.2 Roll all legs of your options strategy

When rolled, all the legs of your options strategy will attempt to be closed. The system will then attempt to form a new strategy by using the new contracts opened by the rolling trade placed by the client. If they can't form any strategy, they may both become single options, or separately pair with other single positions as an option strategy if any.

(Please note that the interface shown in the screenshot may differ from the one on your device if your app version is not up-to-date. Any securities appearing in the screenshot are for illustration only and do not constitute any investment advice. )

3. Why investors roll options

Investors often roll options for a number of reasons, such as securing a profit, managing risk, or reducing cost. The approach they take to rolling their options is based on their investment objective.

Keep in mind that rolling options does not ensure a profit or guarantee against a loss. An investor may also end up compounding their losses.

3.1 Rolling out

Rolling out an option involves closing an existing options position while simultaneously opening a new one with the same strike price, but with a later expiration date. Investors may do this in an attempt to earn more premiums, extend the trading duration, or adjust the breakeven point of their positions.

3.2 Rolling up/down

Rolling up or down an option involves closing an existing options position while simultaneously opening a new one with the same expiration, but at a higher or lower strike price. Investors may do this in an attempt to earn more premiums, and adjust the breakeven point of their positions.

Examples

A. To roll up a call option is commonly used to secure unrealized profits from the previous call option position.

B. To roll down a put option is commonly used to secure unrealized profits from the previous put option position.

C. To roll the option leg in a covered stock strategy is commonly used to earn more premiums and reducing the cost of holding the stock.

Please note that rolling a position involves closing an existing position and realising a gain or loss while opening a new position. You may also end up exacerbating any losses. Rolling out extends the duration, which also increases the risk because there is more time for the price of underlying security to move unfavourably.

4. Requirement for US Options Level

-

Option level 1 or 2 are not able to roll options.

-

Option level 3 are only able to roll up or down an option.

-

Option level 4 and above unlocks all options rolling.

(Note: Options trading and level are subject to eligibility requirements.)

Options contracts are derivative products. Trading in options is not suitable for many members of the public. You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances. The risk of loss in trading options is substantial. In some circumstances, you may sustain losses in excess of your initial margin funds. Placing contingent orders, such as "stop-loss" or "stop-limit" orders, will not necessarily avoid loss. Market conditions may make it impossible to execute such orders. You may be called upon at short notice to deposit additional margin funds. If the required funds are not provided within the prescribed time, your position may be liquidated. You will remain liable for any resulting deficit in your account. You should therefore study and understand options before you trade and carefully consider whether such trading is suitable in light of your own financial position and investment objectives. If you trade options, you should inform yourself of exercise and expiration procedures and your rights and obligations upon exercise or expiry.

Rolling options does not ensure a profit or guarantee against a loss. An investor may also end up compounding their losses. By rolling out, the duration is extended, which can also increase risks as there’s more time for the underlying security’s price to move unfavorably. Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.