Options position Greeks

Options position Greeks are metrics that assess the risk and sensitivity of an entire options position to various factors. These factors include changes in the underlying asset price, implied volatility, time decay, and interest rates. By analyzing these metrics, investors can make informed decisions about managing their portfolio.

Keep in mind, Option Position Greeks are calculated using options pricing models and are theoretical estimates. Greek values are based on the assumption that all other factors remain constant. Actual results may vary.

1. Options position Greek definitions

| Options Position Greek | Definition |

| Delta | Measures the theoretical value of an options position when the price of the underlying asset changes by $1. |

| Gamma | Measures the potential change of the position's Delta when the price of the underlying asset changes by $1. |

| Vega | Measures the theoretical value of an options position when the implied volatility (IV) changes by 1%. |

| Theta | Measures the theoretical value of an options position with each passing day as it approaches the expiration date. |

| Rho | Measures the theoretical value of an options position when interest rates change by 1%. |

Keep in mind, Option Position Greeks are calculated using options pricing models and are theoretical estimates. Greek values are based on the assumption that all other factors remain constant. Actual results may vary.

2. Calculation

How to calculate options position Greeks

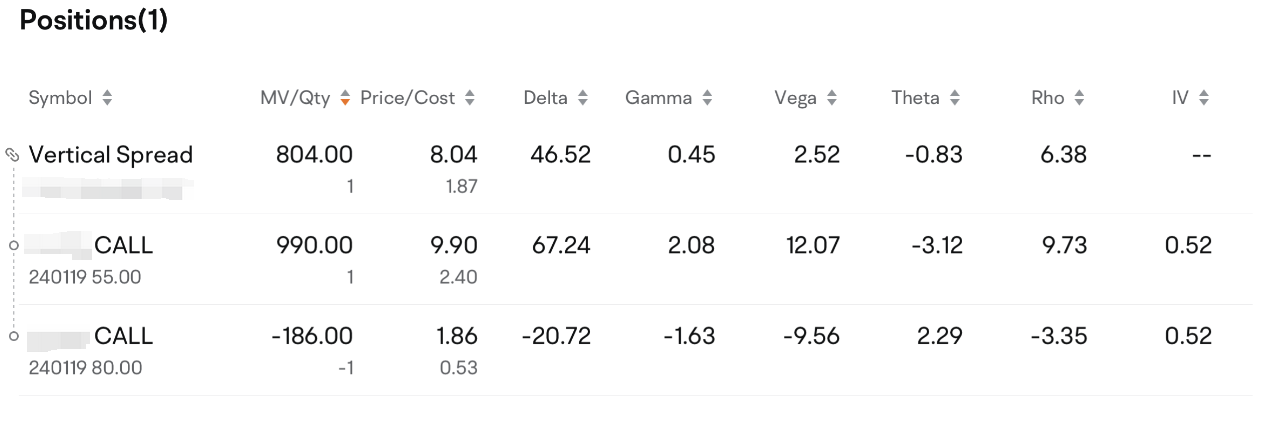

Calculating the options position Greeks can be done using the Greek metrics from the related options. Please note that the Greeks of the options are not the same as the Greeks of the options position.

Formula

Options Position Greek = Options Greek * Number of Contracts * Contract Multiplier

Take the Delta of an options position as an example:

Example 1: Single Options

Suppose you have 10 call option contracts for stock XYZ, and each contract has a Delta of 0.75. Delta of the position = 0.75 x 10 x 100 = 750.

This means that if XYZ rises by $1, the value of the option position will theoretically increase by $750; if XYZ falls by $1, the value of the option position will theoretically decrease by $750.

Example 2: Option Strategy

Suppose you hold 15 units of long call spreads for stock XYZ, which consists of buying 15 call options with a strike of $55 and selling 15 call options with a strike of $60.

-

If the Delta of the XYZ call with a $55 strike is 0.61, Delta of the position = 0.61 x 15 x 100 = 915

-

If the Delta of the XYZ call with a $60 strike is 0.29, Delta of the position = -0.29 x 15 x 100 = -435

Therefore, the Delta of the option strategy position = 915 + (-435) = 480. This means that if stock XYZ rises by $1, the value of the option position will theoretically increase by $435.

Keep in mind that Delta is constantly changing and may not precisely forecast the actual change in an option position's value.

Notes:

-

The options position Greeks differ from the options Greeks shown on the Detailed Quotes page. The options position Greeks measure the actual risk of holding a position using the formula shown above.

To learn more about the options Greeks on the Detailed Quotes page, click here.

-

For any portfolio that contains products other than underlying stocks and options, such as Hong Kong stock warrants, calculating the options position Greeks is not supported.

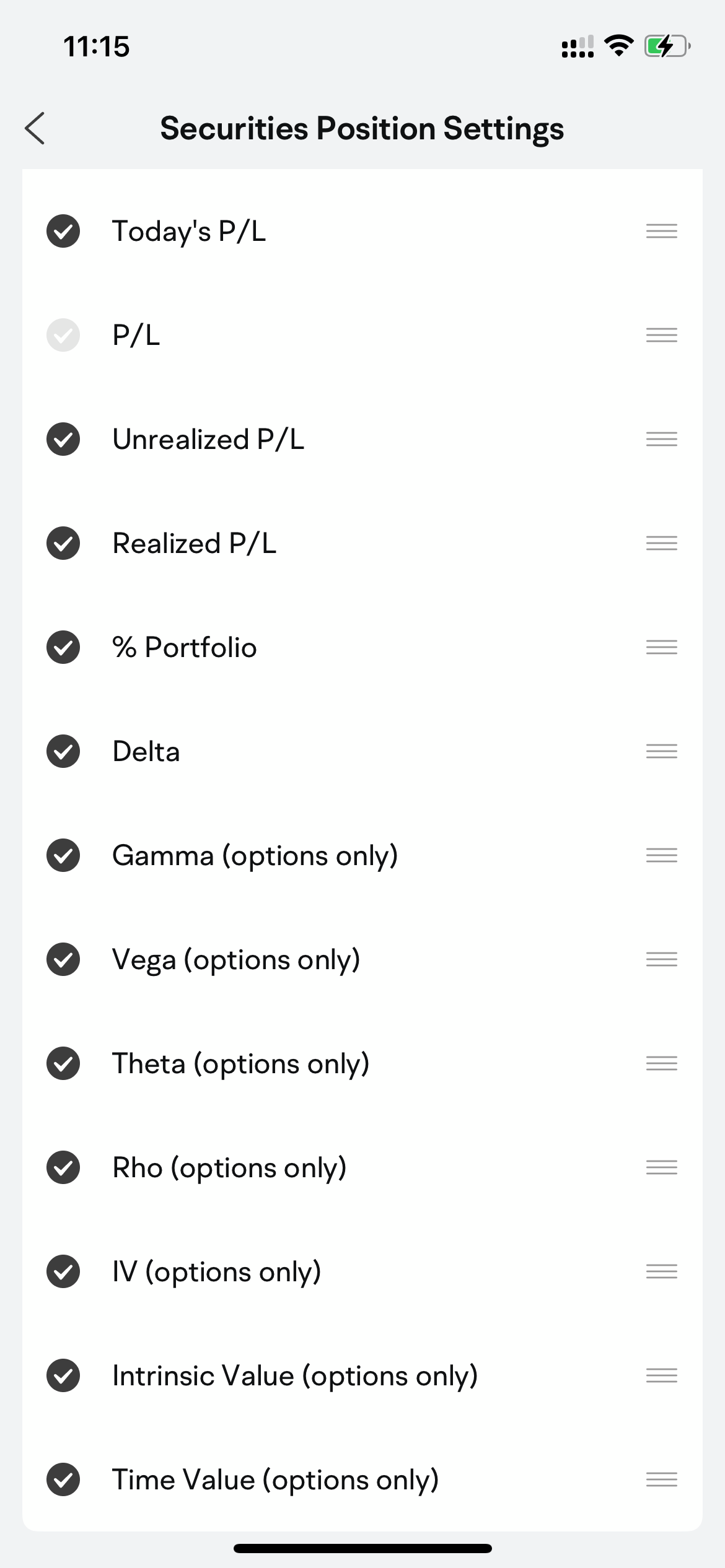

3. How to show or hide options position Greeks

To show or hide the Greeks of your options positions in the app:

Go to Settings > Trade > Position Display > Securities

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc.

In the U.S., investment products and services available through the moomoo app are offered by Moomoo Financial Inc., a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) and a member of Financial Industry Regulatory Authority (FINRA)/Securities Investor Protection Corporation (SIPC).