What are Index Options

2. Index options vs stock options

Index options are a type of product where the underlying asset is an index, rather than a specific stock or commodity. Index options are cash settled when exercised as an underlying index is non-tradable. Cash settlement does not involve the transfer of underlying assets. Instead, it calculates the contract value after option exercise based on the strike and settlement price.

Each region or country may have their own types of index options available for trade, but the following information is for index options in the US market.

1. Contract terms

Functionally, index options operate similarly to stock options, except that the asset being traded is the price index for a particular market. Depending on the type of price index being traded, these options can be categorized into stock index options and volatility index options.

Moomoo Financial Inc. currently supports trading US index options including SPX (S&P 500 Index), VIX (CBOE Volatility Index), XSP (Mini S&P 500 Index), DJX (1/100 Dow Jones Industrial Average Index), RUT (Russell 2000 Index), and NDX (Nasdaq 100 Index). More index options will be available soon.

SPX, VIX, XSP, DJX, and RUT are exclusively traded at the Chicago Board Options Exchange (CBOE), while NDX is traded at the Nasdaq GEMX, ISE, and PHLX. All the aforementioned index options are cleared by the Options Clearing Corporation (OCC).

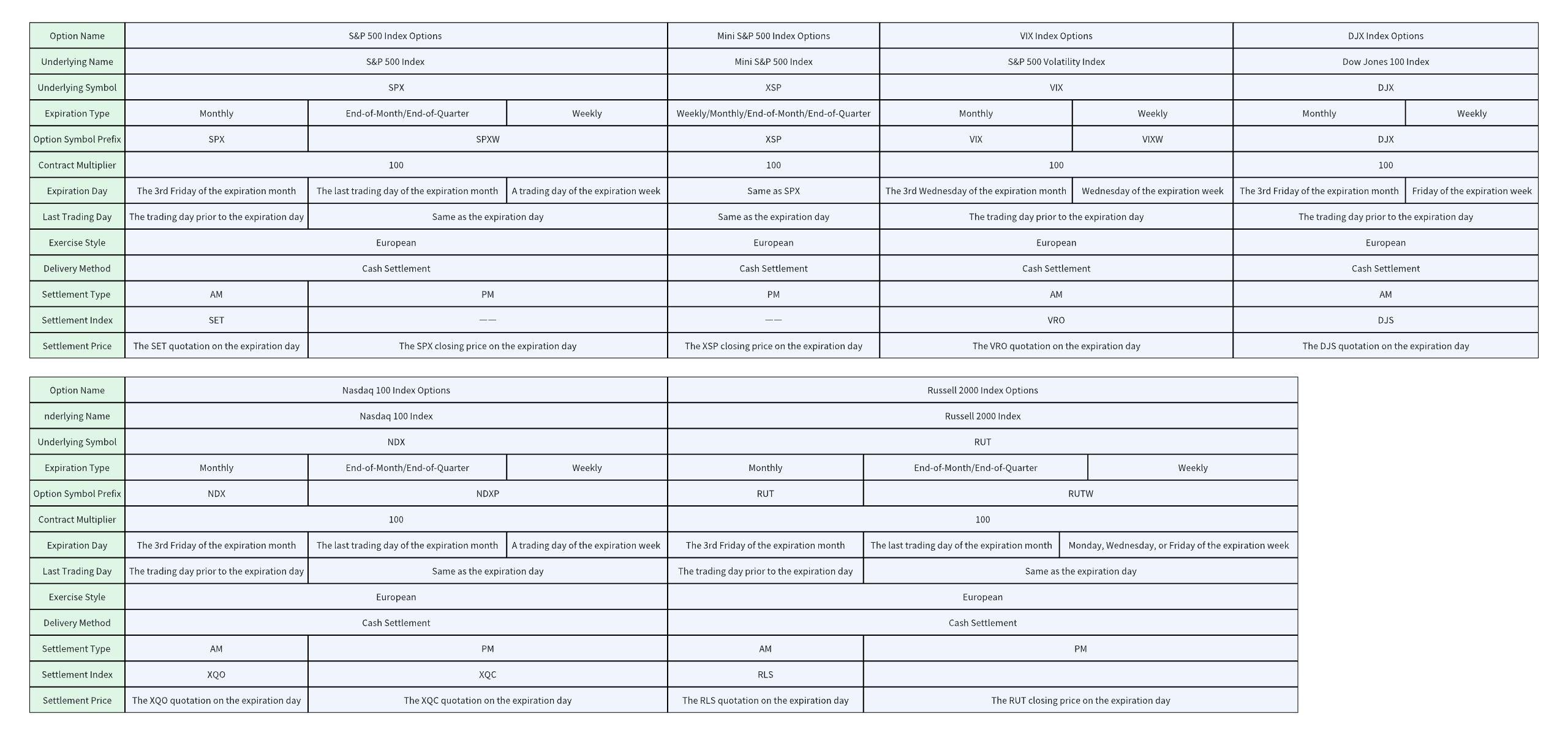

The core contract terms of the index options are as follows:

2. Index options vs stock options

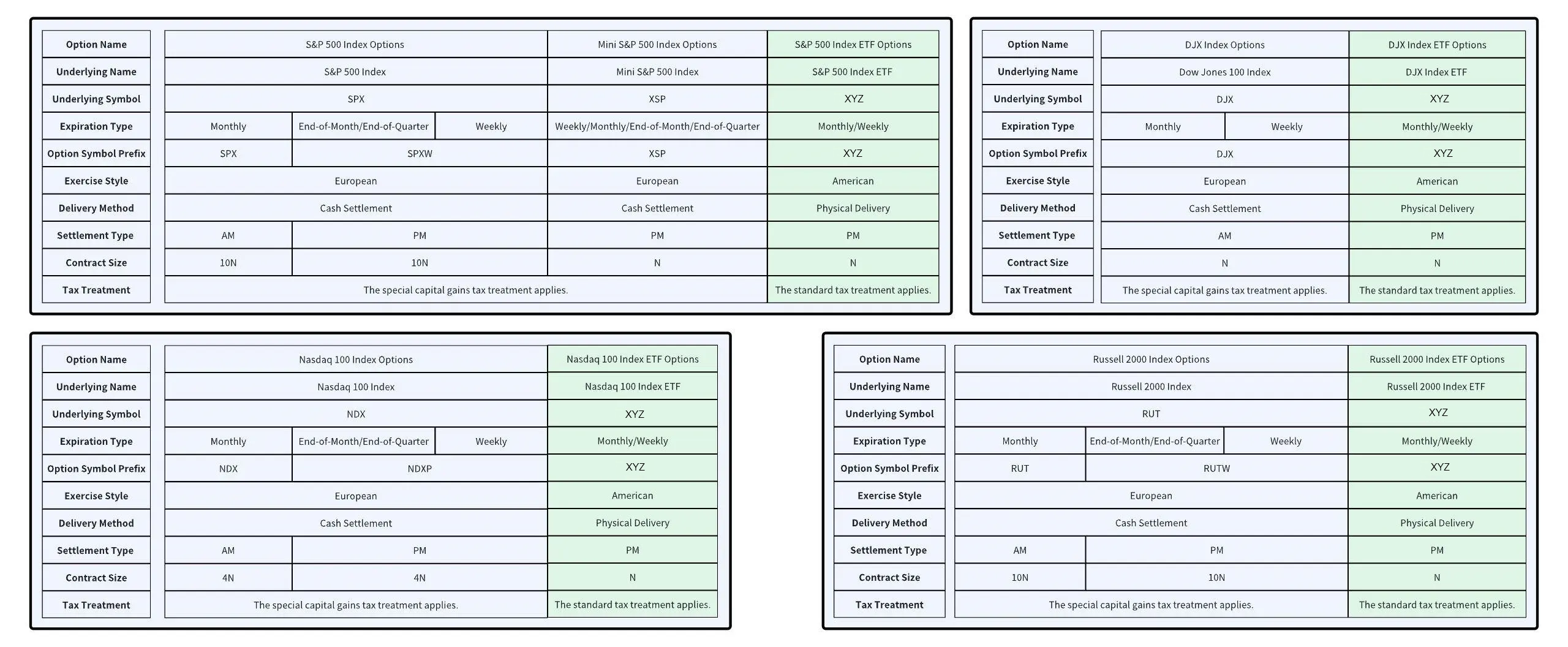

Index options and ETF options are available for various stock indices in the US market. Index options and ETF options are types of derivative products with exposure to a broad market, sector, or industry.

Consider the following attributes below for how index options differ from individual stock options and ETF options.

(Above mentioned examples are for illustrative purposes only.)

Exercise style: American vs European

Individual stock options and ETF options are typically American-style options, while the majority of index options are European-style. Unlike American-style options, European-style options do not allow for early exercise or assignment.

Moomoo Financial Inc. currently only supports trading European-style US index options.

Delivery method: Physical delivery vs cash settlement

For individual stock options, the delivery method is physical delivery. By comparison, the delivery method for index options is cash settlement, as they are non-tradable. Cash settlement does not involve the transfer of underlying assets. Instead, it calculates the contract value after option exercise based on the strike and settlement price.

Example

Suppose the strike price for an SPX index call option is $4,420:

-

If its settlement price upon expiration is $4,432, the settlement value of the option: ($4,432 – $4,420) * 100 = $1,200.

-

If its settlement price upon expiration is $4,418, the settlement value of the option will be $0.

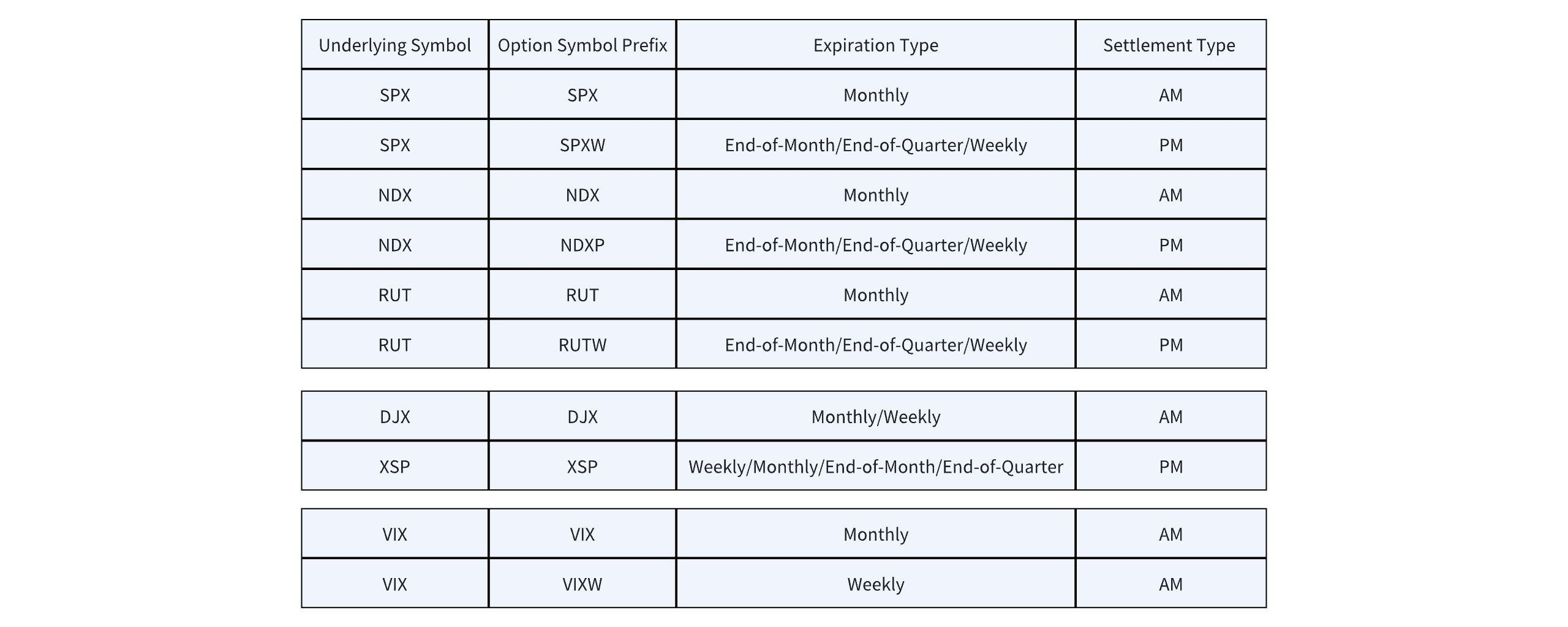

Settlement Type: AM vs PM

-

AM-settled options:

-

The last trading day is usually the trading day prior to the expiration date.

-

The settlement price is calculated based on the opening price of the underlying index on the expiration date and is subject to the settlement index.

-

PM-settled options:

-

The last trading day is the same as the expiration date.

-

The settlement price is calculated based on the closing price of the underlying index on the expiration date.

All individual stock options are PM-settled options, whereas there are either AM-settled or PM-settled index options.

Note: The settlement index is calculated based on the actual prices of the underlying assets of the contract at a specific time during the trading day. The final settlement price may differ from the closing price of the underlying asset.

Contract size

An option's contract size is based on the contract multiplier and the strike price. Usually, the contract size of index options is larger than that of its corresponding ETF option. For example, the contract size of an SPX index option is about 10 times that of the SPX index ETF options.

Contract size = Multiplier * Strike Price

Tax treatment

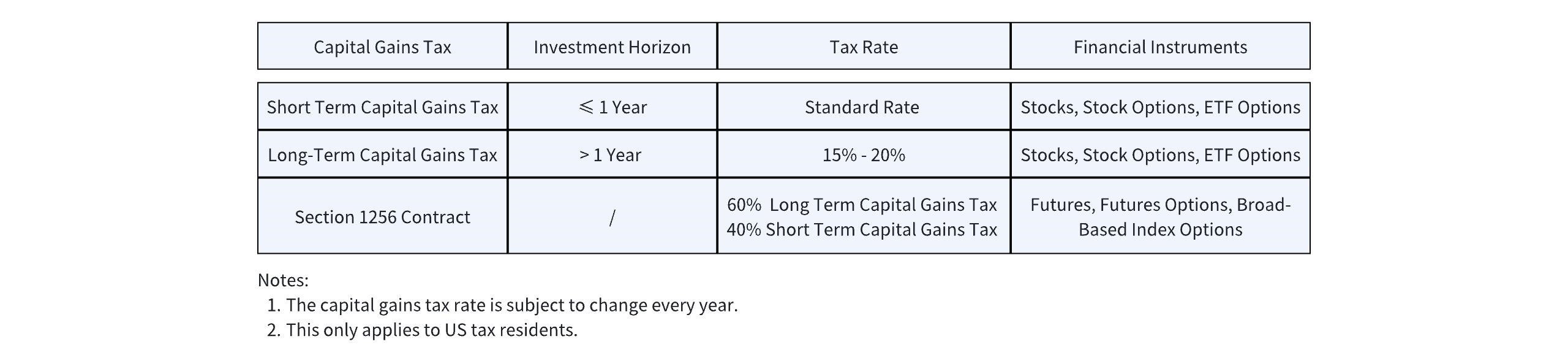

Both index options or ETF options can be traded to track a specific index. However, broad-based index options are eligible for special tax treatment. According to the US Section 1256 of the US internal Revenue Code, any gain or loss on index option contracts is treated as 60% long-term capital gain or loss and 40% short-term capital gain or loss, regardless of how long the investor actually holds the contracts.

Example

Investor A has made a profit of $10,000 within a year by trading ETF options, and Investor B has made a profit of $10,000 within a year by trading broad-based index options. If the standard rate for short-term capital gains tax is 32% and the long-term capital gains tax rate is 20%, the after-tax income of the two investors is:

-

Investor A: $10,000 – $10,000 * 32% = $6,800

-

Investor B: $10,000 – $10,000 * 40% * 32% – $10,000 * 60% * 20% = $7,520

Keep in mind: Moomoo Financial and its affiliates do not provide tax advice and any tax-related information provided is general in nature and should not be considered personalized tax advice. Consult a tax professional regarding your specific tax situation. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. The content is for informational purposes and is not a recommendation of any specific securities. The data and information provided has been obtained from sources considered to be reliable, but Moomoo Financial and its affiliates do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC.