American depositary receipt (ADR) escrow fee

1. Introduction to ADR

ADRs (American Depository Receipts) represent ownership of foreign company shares which can be traded in US markets. A custodian bank will issue ADRs after depositing certain amount of foreign company shares, please note that the exchange ration may not be 1:1 between ADRs and ordinary shares. For example, 5 ordinary shares may represent only one ADR.

2. How the ADR FEE being charged

DTC(Depository Trust Company) has started charging ADR FEE from broker-dealers and clearing firms since 2008, which in turn pass the fee to the investors. As ADR FEE settlement will take some time, Moomoo Financial Inc. will freeze the corresponding amount on the record date and deduct on the bill date.

Generally speaking, ADR FEE charging process resembles dividend paying process. Announcement date, Record date and Bill date are three important dates, ADR custodian bank will update these dates regularly.

Announcement Date: Custodian bank announce incoming ADR FEE

Record Date: Customers with settled positions on this date will be charged for ADR FEE, even if they sold the positions thereafter.

Bill Date: The actual charge date, thedate may slightly differ between custodian bank to broker and broker to client due to time need for settlement.

3. ADR FEE rateand charge frequency

ADR FEE rate range between 1 – 5 cents per share, different ADRs will have different charge rate and bill date, if corresponding stock issues dividend during the year, ADR FEE will be deducted from the dividend amount in the name of dividend fee, if corresponding stock issues no dividend, ADR FEE should be paid separately.

ADR FEE are charged 1 to 4 times per year normally, the frequency might be be higher under special circumstances. The charge amount will be split accordingly. For example, if annual ADR FEE is 2 cents and the charging frequency is 4 times a year, 0.5 cent will be charged each time.

4. Check ADR details

The majority of ADRs are under custodian of four major banks - BNY Mellon, Deutsche Bank, Citi Bank and J.P. Morgan. You may check ADR information through their official ADR sites.

Some ADRs are under custody of a single bank, if you cannot locate information at a certain bank, please try the other 3.

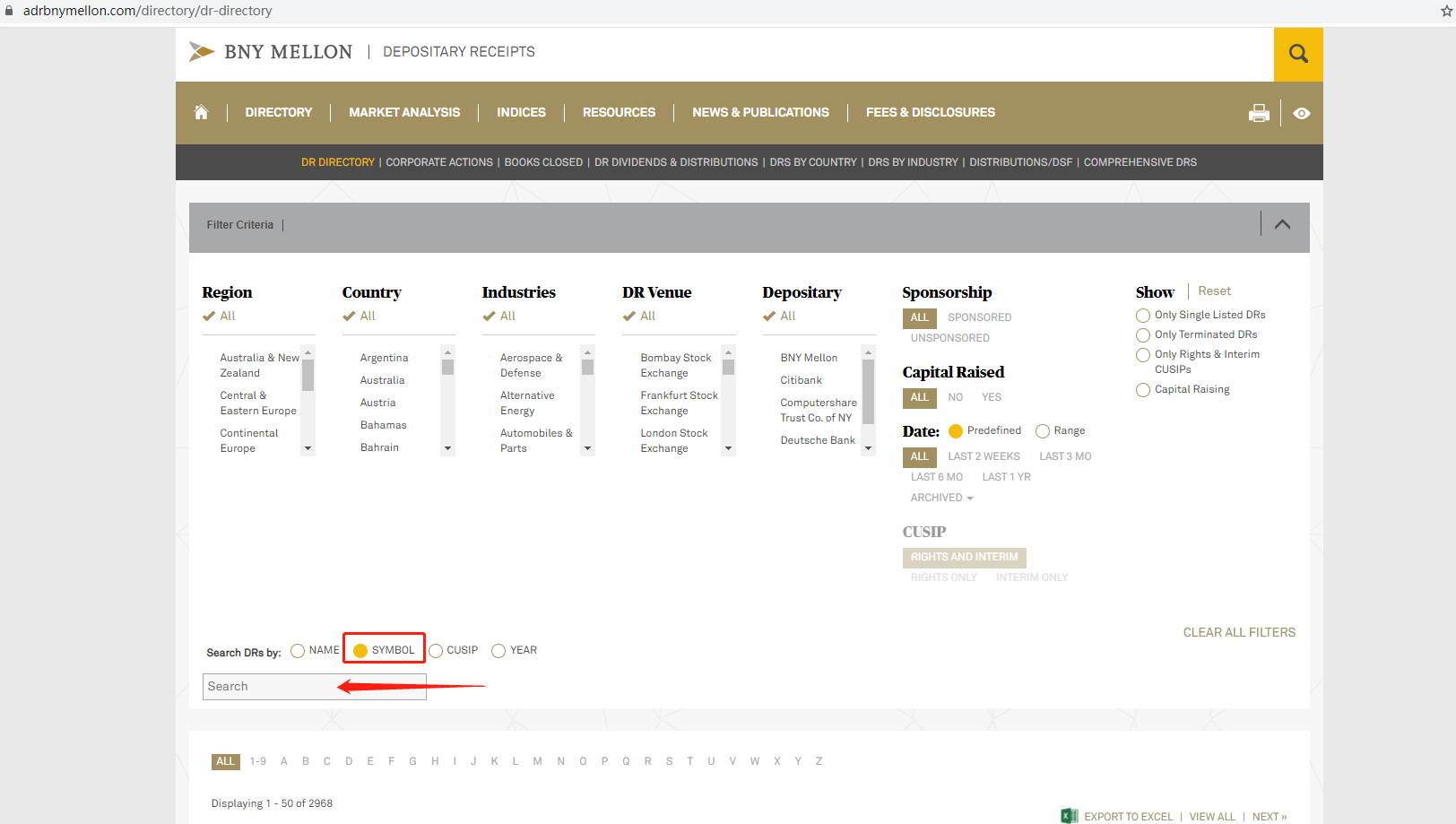

4.1 BNY Mellon

After landing at BNY Mellon ADR site, select ‘Symbol’, enter stock code, ADR details will be displayed at the pop-up window.

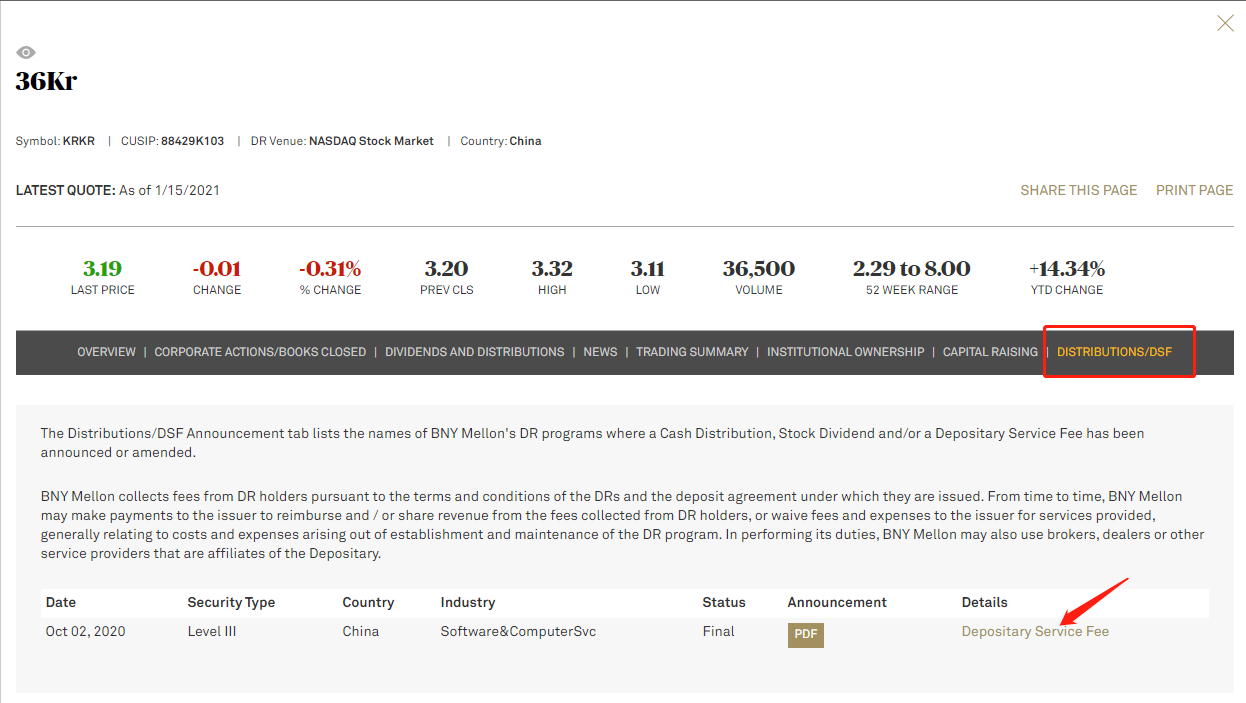

Click ‘Distribution/DSF’ at ADR details page, then click ‘Depositary Service Fee’, you will be able to see ADR FEE details, you may also access bank announcement via the pdf icon on the page.

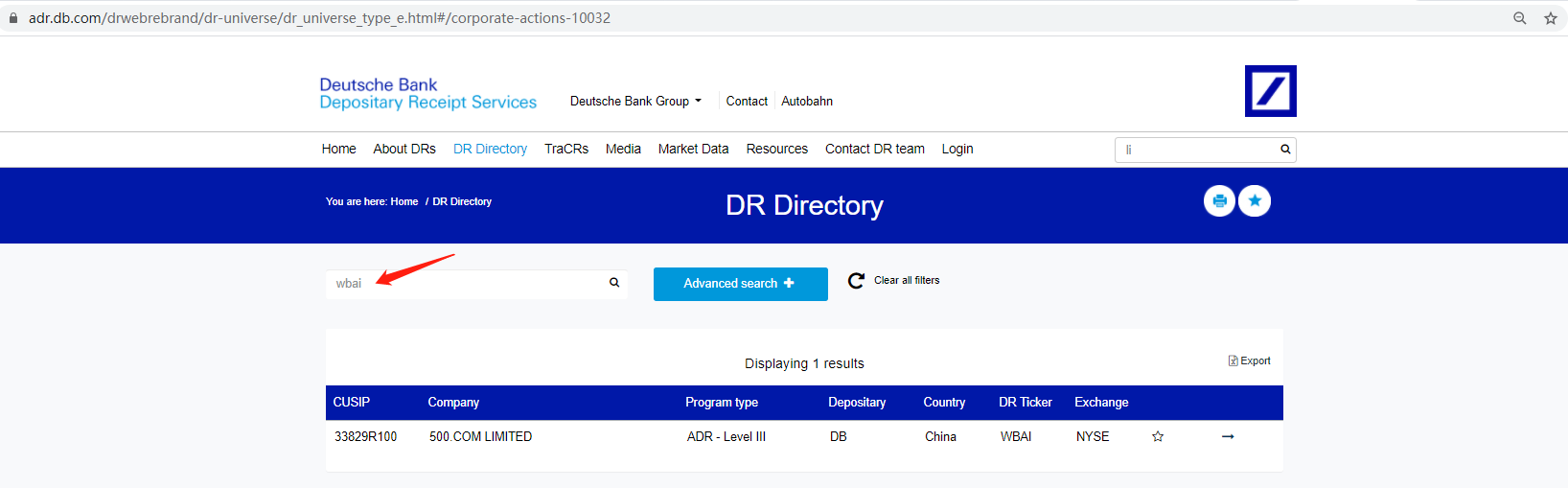

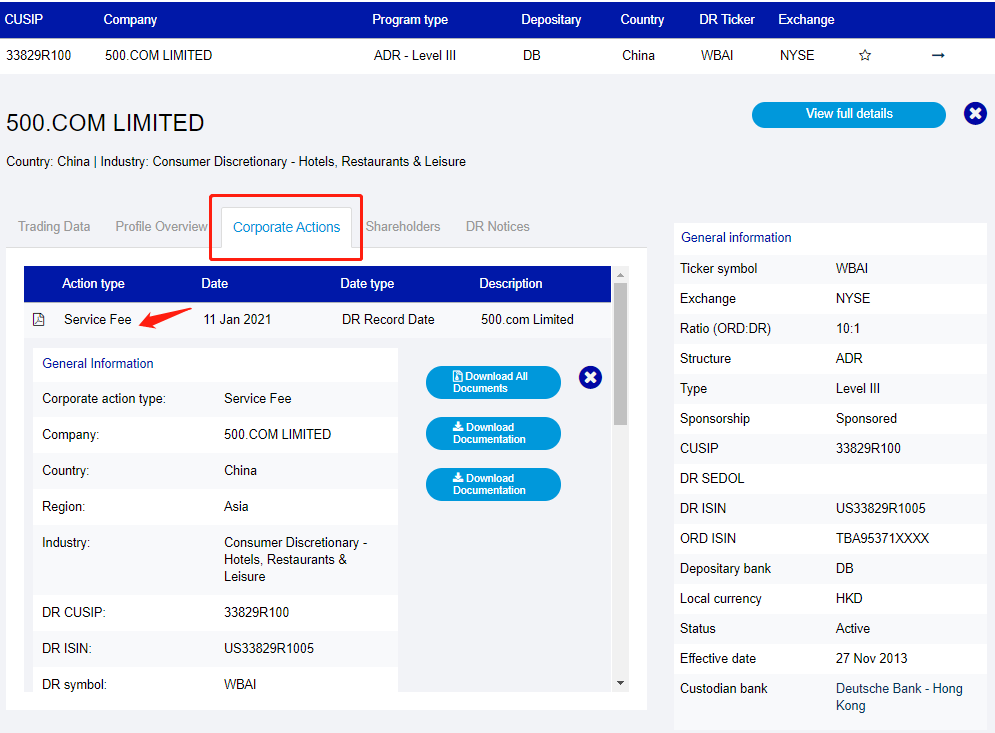

4.2 Deutsche Bank

Search stock symbol after landing at Deutsche Bank ADR site, ADR details will display after clicking ‘Advanced search’.

Click ‘Corporate Actions’ tab at the details page, ADR Fee will display after clicking ‘Service Fee’, you may also download the bank announcement from the ‘Download Documentation’ link as well.

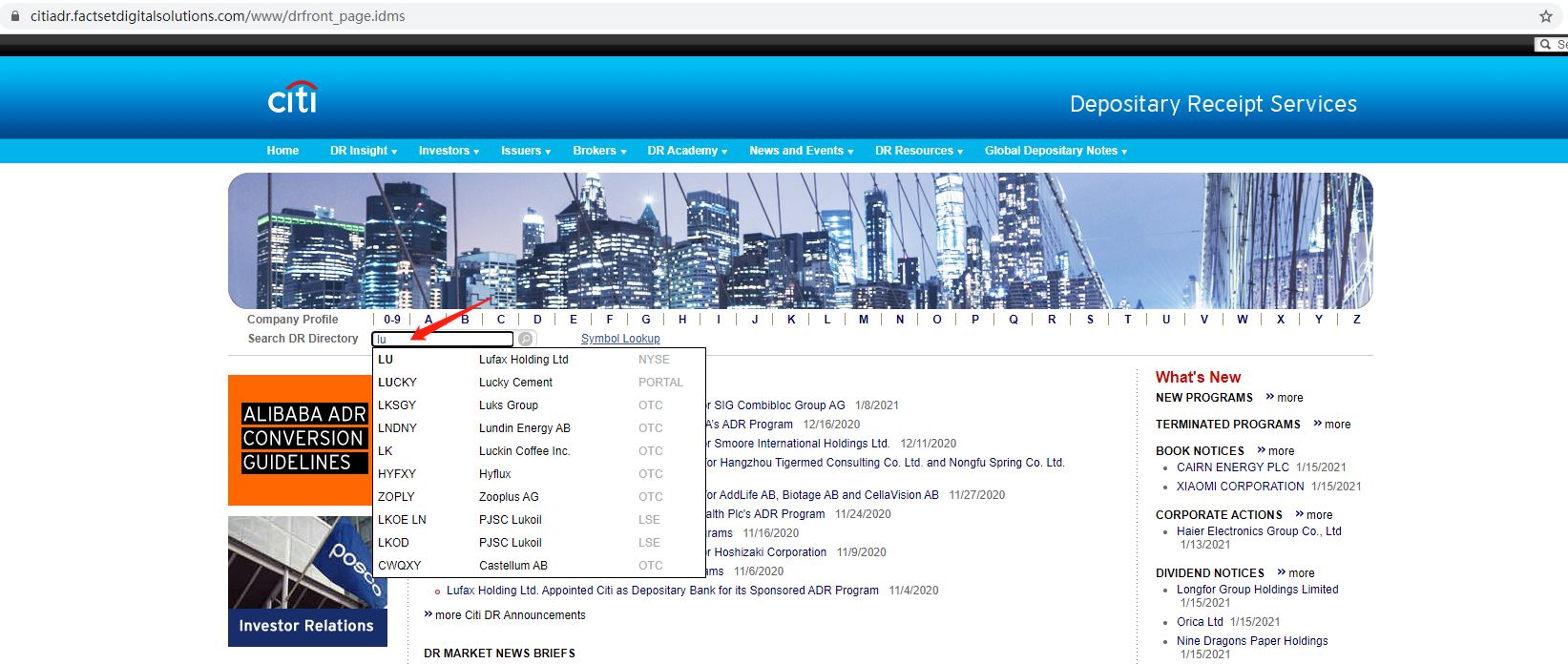

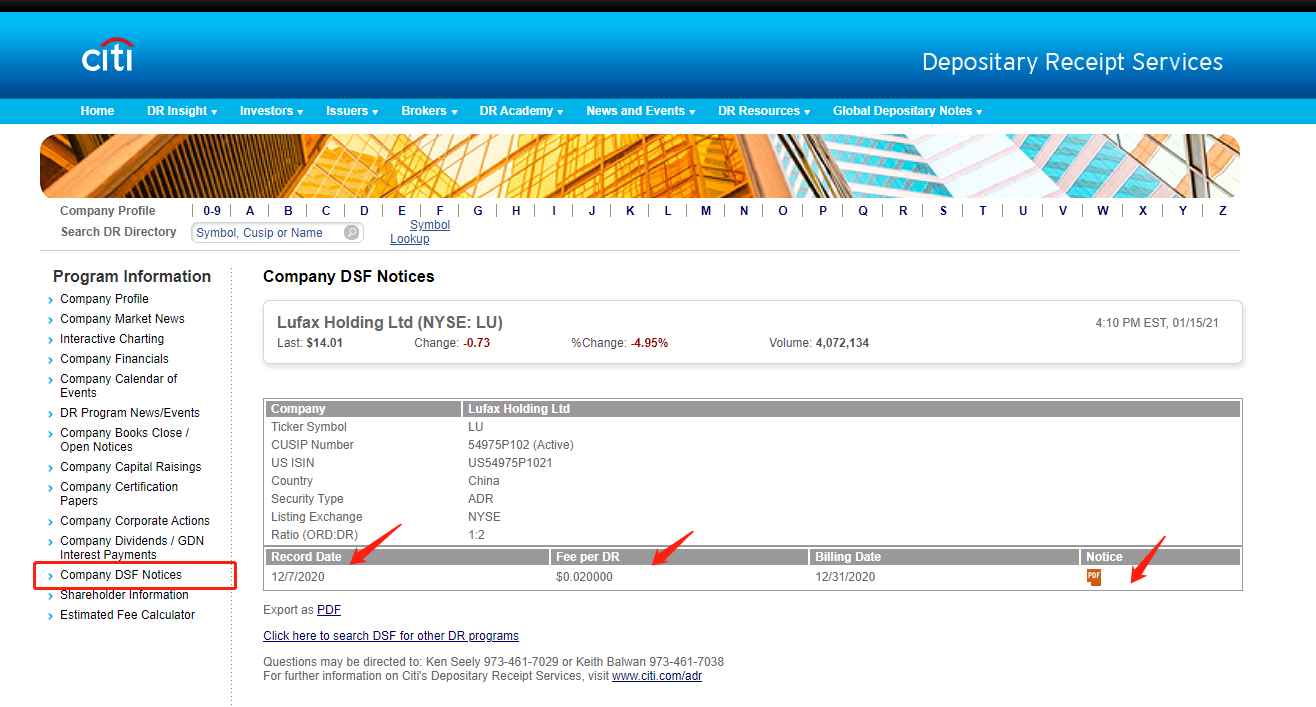

4.3 CitiBank

Search stock symbo lafter landing at Citi Bank ADR site, ADR details will display after clicking on the stock code.

You will see ADR Fee details after clicking ‘Company DSF Notices’ at the right-hand side navigation bar, you may also download the bank announcement by clicking on the PDF sign at the ADR details page.

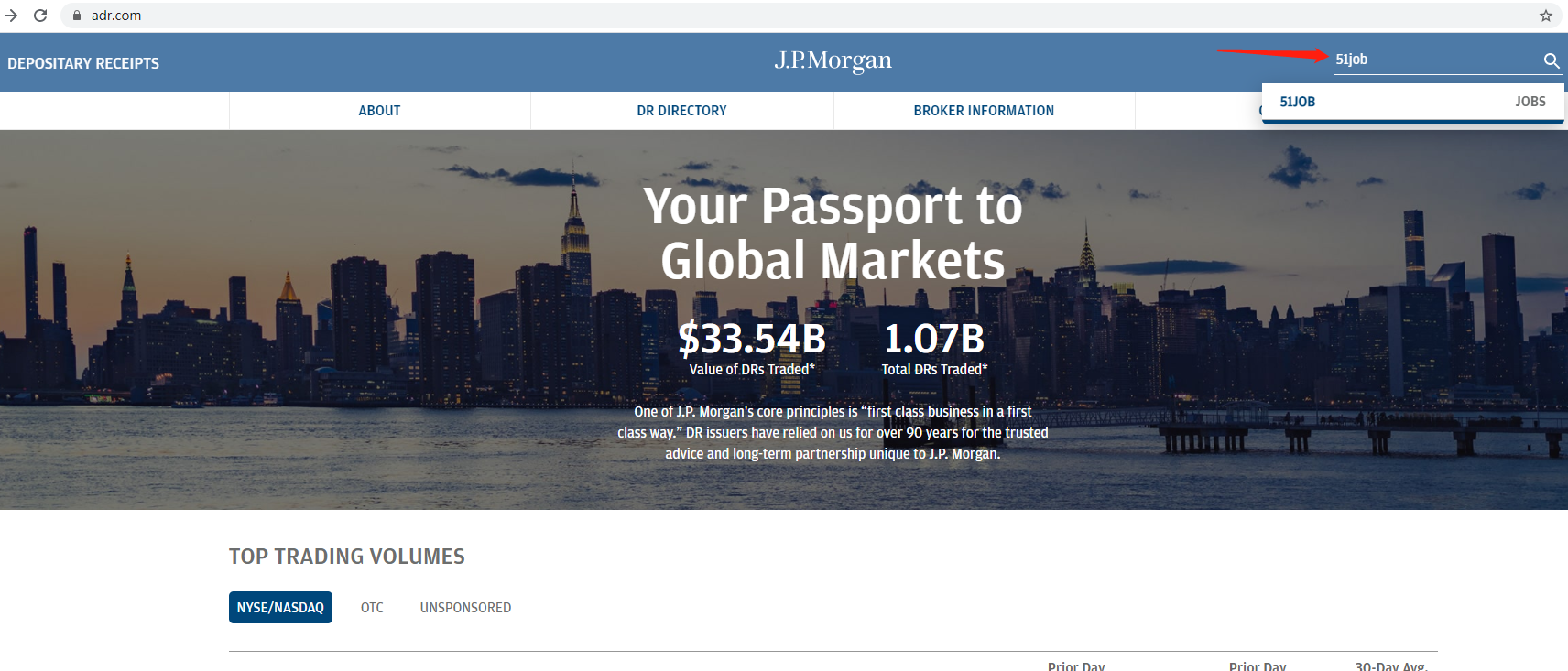

4.4 J.P.Morgan Bank

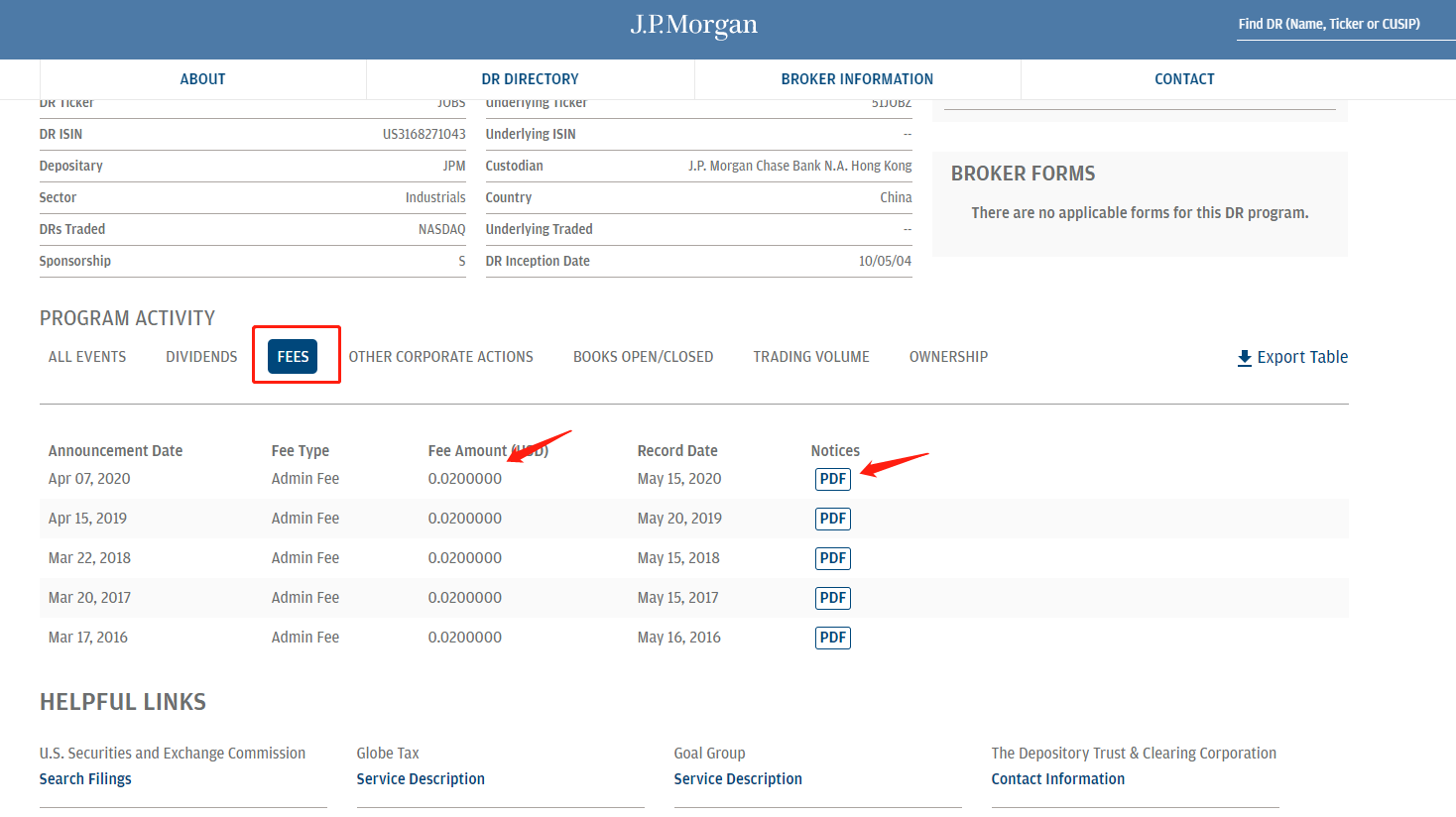

Search stock symbol at the search bar after landing at J.P.Morgan Bank ADR site, ADR details will display after clicking on the stock code. Click ‘Fees’ tab at the ‘PROGRAM ACTIVITY’ to view ADR Fee details, you may also download the bank announcement by clicking on the PDF sign at the ADR details page.

Click ‘Fees’ tab at the ‘PROGRAM ACTIVITY’ to view ADR Fee details, you may also download the bank announcement by clicking on the PDF sign at the ADR details page.

5. ADR Fee frozen details enquiry

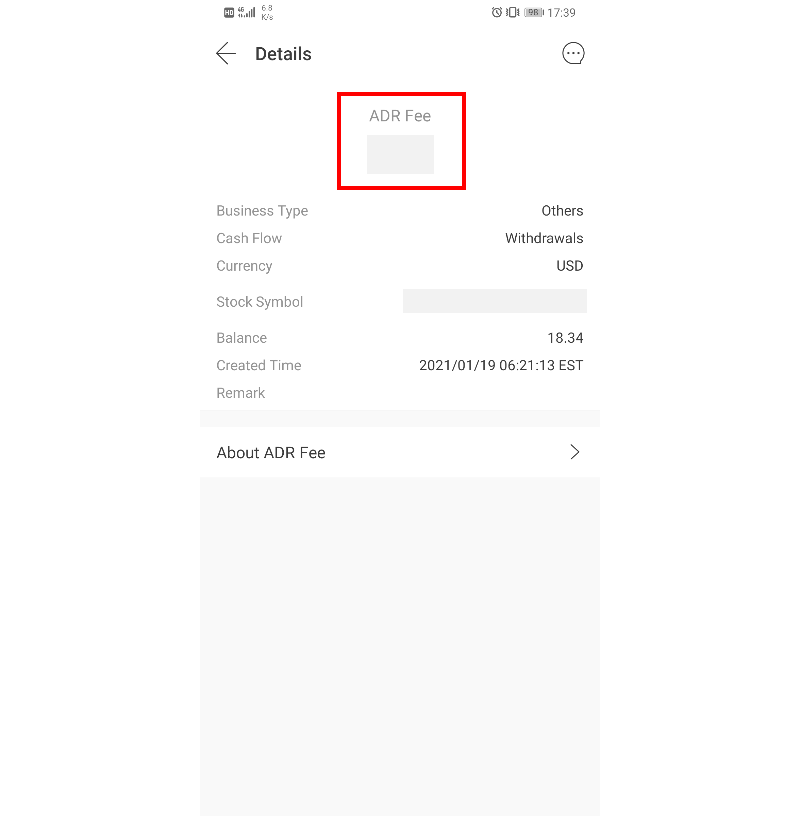

5.1 via APP

You may access ADR fee frozen details via: Trade-> BrokerageAccount->US->Funds on Hold->Details

6. ADR Feed eduction details enquiry

You may access it fromApp via US Margin Account -> Fund Details, kindly note the entry with name ‘ADR Fee’