Moomoo Financial Inc. Fee Schedule for U.S. Residents

Updated on 1 April, 2024 EST

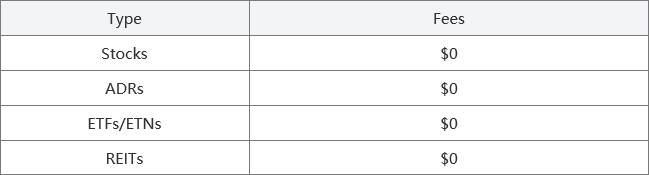

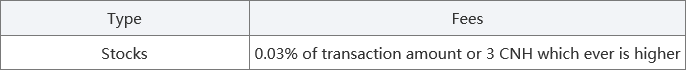

1. U.S. Stocks

1.1 Commission

Note: Stocks include individual stocks, OTC stocks, preferred stocks, fractional shares etc.

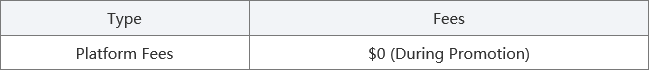

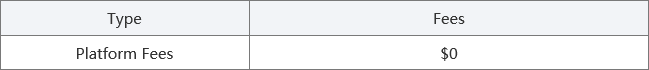

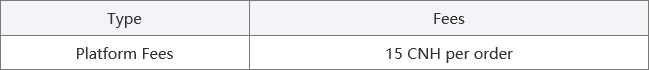

1.2 Platform Fees

Note: *Promotion begins on Nov 2018 and may end at anytime with 30 days notification ahead.

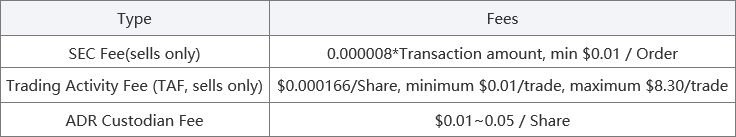

1.3 Regulatory Fees

Note: ADRs (American Depository Receipts) represent ownership of non-U.S. company shares which can be traded in U.S. markets. Investors with ADR settled positions will be charged ADR Fees by DTC (Depository Trust Company), commonly at $0.01-$0.05 per share every financial year. DTC (Depository Trust Company) has started charging ADR Fees from broker-dealers and clearing firms since 2008, which in turn pass the fees to the investors.

1.4 US Corporate Action

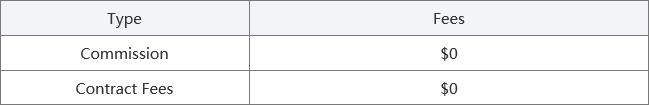

2. Stock Options/ETF Options

2.1 Trading Fees

2.2 Platform Fees

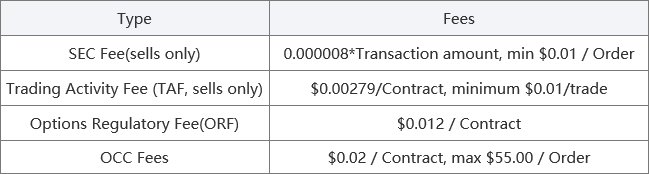

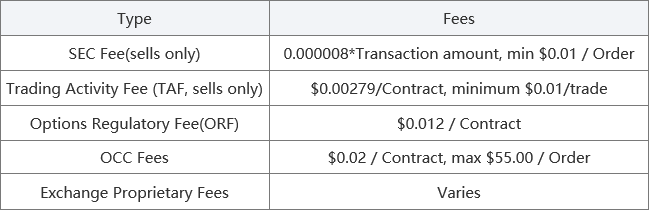

2.3 Regulatory Fees

Notes:

1. The Options Regulatory Fee ('ORF') is a fee assessed by exchanges on their members. The ORF fees are typically passed-through by members to their customers. ORF is collected by The Options Clearing Corp ("The OCC") on behalf of the U.S. options Exchanges. The stated purpose of the fee is to recover a portion of the costs related to the supervision and regulation of the options markets. These activities include routine surveillance, investigations, as well as policy, rulemaking, interpretive and enforcement activities. The applicable fee rate may result in a discrepancy with the fee charged by the upstream brokers or the relevant exchanges, and any excess fee will be retained while deficiency will not be charged to clients.

2. The OCC fees are fees charged by the OCC to its members. Like the ORF, these fees are passed through from the clearing broker to Moomoo Financial Inc. to Moomoo Financial Inc.'s clients.

3. ORF Fee varies by options exchange. Moomoo Financial Inc. will pass through to its customers the blended rate charged by its clearing broker. The clearing broker may periodically adjust the such blended rate. The rate that you are charged will be shown on your trade confirmations.

3. Index Options

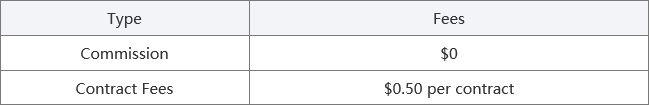

3.1 Trading Fees

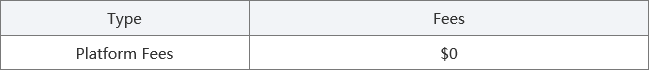

3.2 Platform Fees

3.3 Regulatory Fees

Notes:

1. The Options Regulatory Fee ('ORF') is a fee assessed by exchanges on their members. The ORF fees are typically passed-through by members to their customers. ORF is collected by The Options Clearing Corp ("The OCC") on behalf of the U.S. options Exchanges. The stated purpose of the fee is to recover a portion of the costs related to the supervision and regulation of the options markets. These activities include routine surveillance, investigations, as well as policy, rulemaking, interpretive and enforcement activities. The applicable fee rate may result in a discrepancy with the fee charged by the upstream brokers or the relevant exchanges, and any excess fee will be retained while deficiency will not be charged to clients. ORF Fee varies by options exchange. Moomoo Financial Inc. will pass through to its customers the blended rate charged by its clearing broker. The clearing broker may periodically adjust the such blended rate. The rate that you are charged will be shown on your trade confirmations.

2. The OCC fees are fees charged by the OCC to its members. Like the ORF, these fees are passed through from the clearing broker to Moomoo Financial Inc's clients.

3. For details about exchange proprietary fees, click here.

4. Clients will be charged the Exchange Proprietary Index Option Fees associated with the Proprietary Index Options products provided by the Chicago Board Options Exchange (CBOE), which are subject to change without notice. A copy of the CBOE Options Exchange Fee Schedule can be found on www.cboe.com. From time to time, Moomoo Financial Inc. may run promotions that waive the Exchange Proprietary Index Option Fees.

4. Hong Kong Stocks

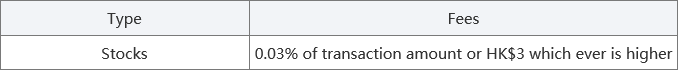

4.1 Commission

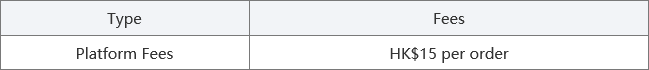

4.2 Platform Fees

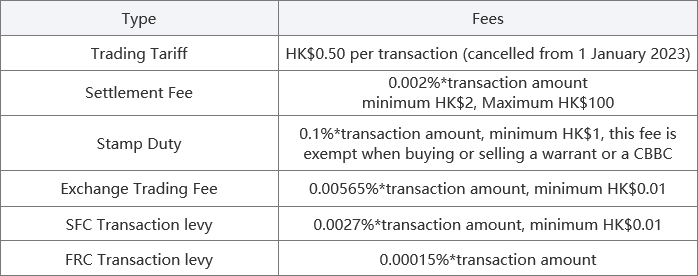

4.3 Regulatory Fees

Note: According to HKEX circular, with effect from 17 November 2023, Stamp Duty has been revised from 0.13% to 0.10%.

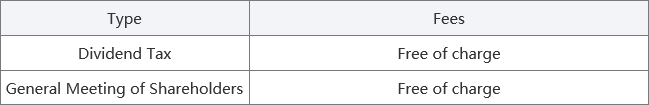

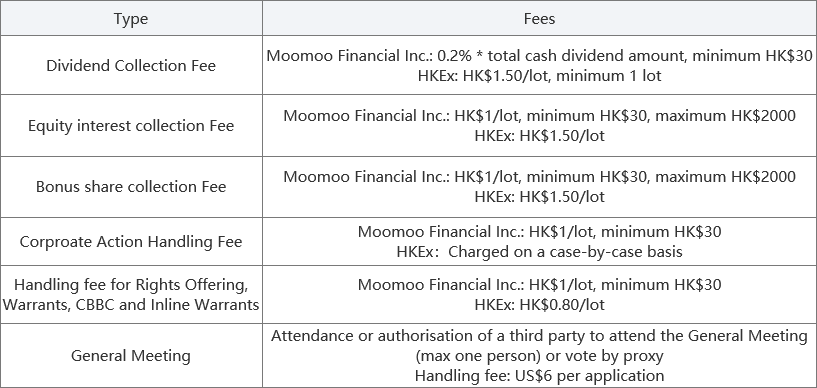

4.4 HK Corporate Action

5. China A-shares

5.1 Commission

5.2 Platform Fees

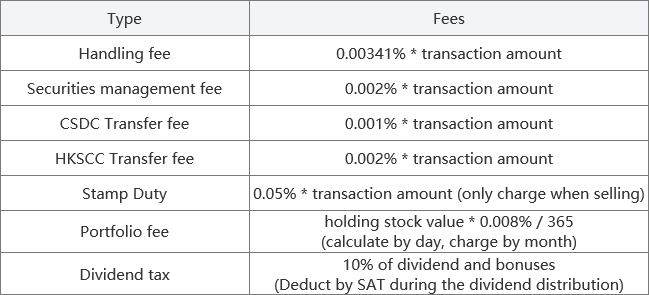

5.3 Regulatory Fees

Note:

1. China A-share ETFs are exempt from Securities Management Fees, Transfer Fees(CSDC ), and Stamp Duty, and the handling fee is 0.004% of the transaction amount. Other charges are the same as the underlying shares.

2. Handling fee revised to 0.00341% of transaction amount from 28 August 2023.

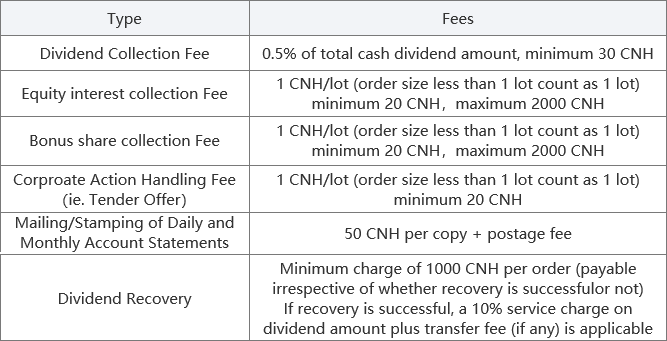

6.4 China A-Share Corporate Action

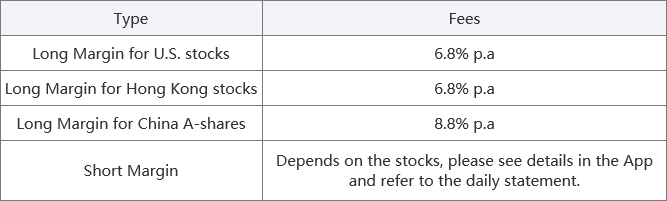

6. Margin Rate

Note: We reserve the right to amend our margin interest rate from time to time in response to changes in prevailing interest rates and other factors. The Margin Rate is subject to change without notice.

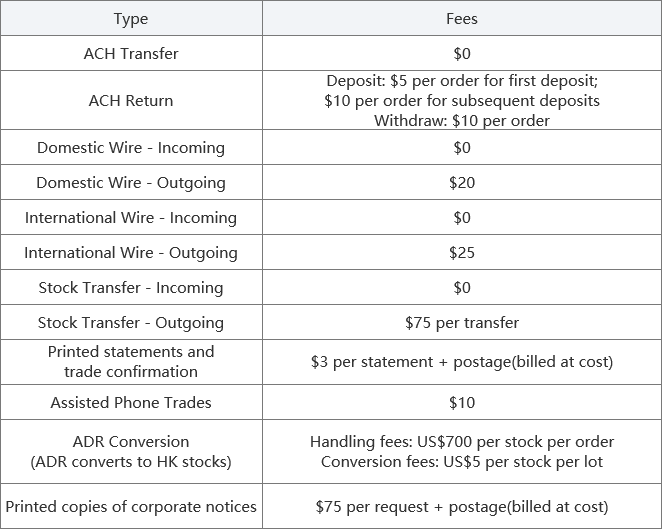

7. Service Fees

Notes:

1. Additional wire transfer fees charged by any originating, intermediary, or recipient bank may apply.

2. As of ADR conversion, one lot consists of 100 ADS, and less than one lot is rounded up to one lot. Please note that the adjusted ADR Conversion fee will take effect on November 8, 2022.

3. Per regulatory requirements, we must provide statements and confirms to clients. The printed materials involve securities offered through Moomoo Financial Inc., Member FINRA/SIPC, and are subject to fees as mentioned above.

8. Currency Exchange

Moomoo Financial Inc. charges a fee for converting currencies. The amount of the fee varies depending on the currency and may be up to 300 basis points. Should you have any questions regarding the conversion fee, please email our customer service team.

If you would like to know the fees for Non-U.S. resident, Click here.